Home › Forums › Main Forum › Media & News › Harvoni – decline of sales in U.S.?!

- This topic has 26 replies, 11 voices, and was last updated 9 years, 7 months ago by

fitz.

fitz.

-

AuthorPosts

-

22 May 2016 at 9:33 pm #17628

Hi Everybody,

in the latest press release from Gilead (for the first quarter of 2016), available at http://investors.gilead.com/phoenix.zhtml?c=69964&p=irol-earnings, there is a strange information, that by compare with the first quarter from 2015, the sales for Harvoni declined in US, while Sovaldi sales increased slightly, while in Europe Sovaldi sales decreased. Looking at the numbers, the drop in sales for antiviral products seems quite big (US -$1 billion)

Are perhaps US people knowing something more about the drug Harvoni than the rest of the world?

Regards,

RHF

In fiecare an HCV ucide peste 500000 oameni.Medicamentele generice pentru hepatita C functioneaza. Nu deveni statistica! Cauta pe Google “medicamente generice pentru hepatita C”.

HCV kills more than 500000 people every year. HCV generic drugs work. Don’t become a statistic.

By sharing this Youtube video you might save someone’s life!

My TX: HEPCVIR-L[generic Harvoni]-India

SVR52 achieved22 May 2016 at 10:38 pm #17629Interesting question RHF.

I was just checking their site too – but for info on the new drug to be approved by the FDA on June 28th.

Blood transfusion in 1992 – Diagnosed in 2007

Tx naive -G1b – F1

VL 2.270.000

ALT 40

Start tx June 4th/2016 with DAAs – Sof/Led from India

Bloods on two weeks of tx (June 18th)

AST 17 – ALT 10 – GGT 19

Virus UND

Bloods on six weeks of tx (July 16th)

AST 17 – ALT 8 – GGT 12

Virus UND

EOT on August 8th (did 9 weeks and 3 days)SVR 4 Virus UND (September 7th)

AST 13 – ALT 5SVR 14 Virus UND (November 12th)

23 May 2016 at 12:26 am #17634Thankyou for the interesting read

It’s hard to say why a drop in sales. I’m certain it won’t be to do with the effectiveness or safety of the DAAs we have taken or are taking or for some, about to take. Like Meg I researched the new drug but information is sketchy.Interesting snippets from this pdf include Gilead stating “….the potential pricing pressure from additional competitive HCV launches or austerity measures in European Countries and Japan…..”

I’m still arguing the generic case and recoil at Gileads profit margins as we all do.

Another useful doc ty ROhcv for this

Cheers from Ariel23 May 2016 at 3:06 am #17636Maybe it’s the generics

Genotype 1a

Diagnosed in 2004, had HCV for all my adult life. Until 2016!!!!

Harvoni treatment, started 19 March 2016

4 week results Bilirubin 12 down from 14 pre treatment,

Gamma 25 down from 52, ALT 19 down from 63, AST 19 down from 47,

VL <15 down from a lazy 6 million or soEOT Results

Bilirubin 10, GGT 18, ALT 19, AST 21, VL UND12 Weeks post EOT

Bilirubin 11, GGT 16, ALT 22, AST 20, VL UND

Cured baby23 May 2016 at 3:57 am #17637I also read that insurance companies continue to limit access to only the sickest patients, and that many are given only 8 weeks of treatment (less than 6 million VL) that is also cutting in to earnings.

23 May 2016 at 4:12 am #17638The market certainly doesn’t seem happy with their performance. Big initial drop after the announcement with no recovery and in fact a slow worsening. This is a company that was at $1.20 in July last year with projections of $1.50 within 12 months.

G3a since ’78 – Dx ’12 – F4 (2xHCC)

24wk Tx – PEG/Riba/Dac 2013 relapsed

24wk Tx – Generic Sof/Dac/Riba 2015/16 relapsed

16wk Tx – 12/01/17 -> 03/05/17 NS3/NS5a + Generic Sof

SVR7 – 22/06/17 UND

SRV12 – 27/07/17 UND

SVR24 – 26/10/17 UND

23 May 2016 at 8:05 pm #17664

23 May 2016 at 8:05 pm #17664Gilead’s share price is down 32% from a peak of $122.21 on 23 June 2015 pre generics to $83.62 today – post generics.

Current market cap of $112 billion was $164 billion last year, so $52 billion dollars worth of greed has now dissolved before investors eyes.

$50 billion – that’s $50,000,000,000 in investor losses, and last year 500,000 patients died of a now curable illness.

Coincidentally it works out at an investor loss of $100,000 per patient death, more or less exactly the same as the cost per cure.

Karma?

YMMV

23 May 2016 at 10:19 pm #17666I always say to anyone who will listen (and to others as well) that if you own shares in big pharma you are profiting from death and misery

Genotype 1a

Diagnosed in 2004, had HCV for all my adult life. Until 2016!!!!

Harvoni treatment, started 19 March 2016

4 week results Bilirubin 12 down from 14 pre treatment,

Gamma 25 down from 52, ALT 19 down from 63, AST 19 down from 47,

VL <15 down from a lazy 6 million or soEOT Results

Bilirubin 10, GGT 18, ALT 19, AST 21, VL UND12 Weeks post EOT

Bilirubin 11, GGT 16, ALT 22, AST 20, VL UND

Cured baby24 May 2016 at 1:56 am #17669A lot of factors could be contributing to this decline in “blood money”.

I would like to think generics is a major one.

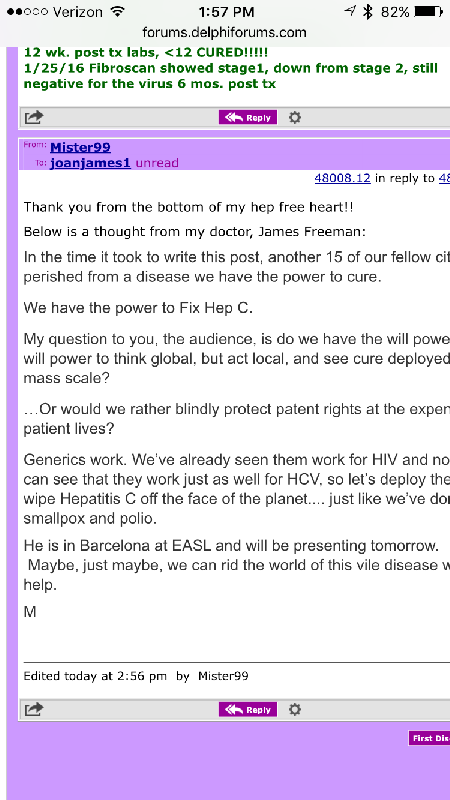

m

Curehcvnow@gmail.com

http://forums.delphiforums.com/generichcvtxG 1a F-1

Started tx 10/23/15 (Meso sof & led) ALT 48 AST 28 v/l 1.6 mil

11/17/15 4 wk lab ALT 17 AST 16 <15

11/18/15 Started Harvoni

12/16/15 8 wk lab ALT: 15 AST: 13 V/l UND

1/14/16 Fin. Tx

7/07/16 UND SVR 2424 May 2016 at 4:47 am #17670Realistically generics are only a tiny contributor and represent one component of competition, but logically only a trivial part because if you have to chase generics, then by definition you’re not in the (potentially) funded population.

And it’s not undercutting pricing from Abbvie that’s driving it either – their volumes are down too.

http://www.bidnessetc.com/58797-gilead-sciences-inc-and-abbvie-face-declining-hcv-scripts/

Effectively bankrupting the major payers like the VA and Medicaid is the primary cause.

Gilead and other pharmaceutical companies are strangling the geese that lay the golden eggs.

YMMV

24 May 2016 at 5:43 am #17671It seems to me the only way these prices will ever come down, is to make a legal case that these companies are ‘profiteering’ or ‘price gouging’.

Seems a lot of politicians are either corrupt or cowards.

24 May 2016 at 1:49 pm #17693Another reason for the fall in share prices could be investor fears of pending class actions:

https://www.chimicles.com/gilead-sovaldi-lawsuit

https://www.schmidtandclark.com/sovaldi-lawsuit

http://www.law360.com/articles/603544/pa-transit-agency-slaps-gilead-with-price-gouging-suit

(see also https://www.chimicles.com/wp-content/uploads/2014/09/Gilead-FAC.pdf)

Diagnosed Jan 2015: GT3, A0+F0/F1. Fatigue + Brain-Fog.

Started Sof+Dac from fixHepC 10-Nov-2015. NO sides.

Pre-Tx: AST 82, ALT 133, Viral Load 1 900 000.

Week4: AST 47, ALT 58. VL < 15 (unquantifiable). Week12 (EOT): AST 30, ALT 26, VL UND Week16 (EOT+4): AST 32, ALT 28, GGT 24, VL UND Week28 (EOT+16): AST 26, ALT 22, GGT 24, VL UND Ever grateful to Dr James. Relapsed somewhere after all that... Bummer! Jan 2018: VL 63 000 (still GT3).24 May 2016 at 2:31 pm #17696I’m sure there were quite a few people with enough money just to self-pay when Harvoni first came out. The “Pamela Andersons” and other financially blessed suffers just bought it.

m

Curehcvnow@gmail.com

http://forums.delphiforums.com/generichcvtxG 1a F-1

Started tx 10/23/15 (Meso sof & led) ALT 48 AST 28 v/l 1.6 mil

11/17/15 4 wk lab ALT 17 AST 16 <15

11/18/15 Started Harvoni

12/16/15 8 wk lab ALT: 15 AST: 13 V/l UND

1/14/16 Fin. Tx

7/07/16 UND SVR 2416 June 2016 at 1:34 pm #19217If one looks today at the stock market for Gild, will notice a nice downward trend in the last month (ref. Point 25.04.2016 till today).

Would I be too malicious if I would wish to GILD a nice and safe trip to the bottom (0$)? I mean, I am concerned about their safe journey in a similar way they care about ours…..

In fiecare an HCV ucide peste 500000 oameni.Medicamentele generice pentru hepatita C functioneaza. Nu deveni statistica! Cauta pe Google “medicamente generice pentru hepatita C”.

HCV kills more than 500000 people every year. HCV generic drugs work. Don’t become a statistic.

By sharing this Youtube video you might save someone’s life!

My TX: HEPCVIR-L[generic Harvoni]-India

SVR52 achieved16 June 2016 at 1:56 pm #19220Gilead stock is currently trading at $83.04, down from $123.57 a year ago. A lot of things have happened since last June:

As I mentioned earlier, the people who had the money in the US, bought Harvoni as soon as it became available. That market is pretty much gone.

The insurers covered many of the sickest patients early on. There are a lot of really sick people who don’t have insurance or have bad insurance coverage, however. Many are still waiting for access to treatment.

The competition has increased, forcing Gilead to negotiate lower prices for insurance companies as well as entire countries. Australia is a good example.

In addition, generics have come into play. I imagine the health tourism business in India is flourishing.

There are other factors I’m sure, but Gilead’s share price seems to have stabilized around $80.00. I imagine it will stay there until someone comes up with a much shorter treatment regimen.

m

Curehcvnow@gmail.com

http://forums.delphiforums.com/generichcvtxG 1a F-1

Started tx 10/23/15 (Meso sof & led) ALT 48 AST 28 v/l 1.6 mil

11/17/15 4 wk lab ALT 17 AST 16 <15

11/18/15 Started Harvoni

12/16/15 8 wk lab ALT: 15 AST: 13 V/l UND

1/14/16 Fin. Tx

7/07/16 UND SVR 24 -

AuthorPosts

- You must be logged in to reply to this topic.