So Big Pharma's argument about pricing goes like this:

We spend a lot on R&D so we need to make a lot back when we find a winner.

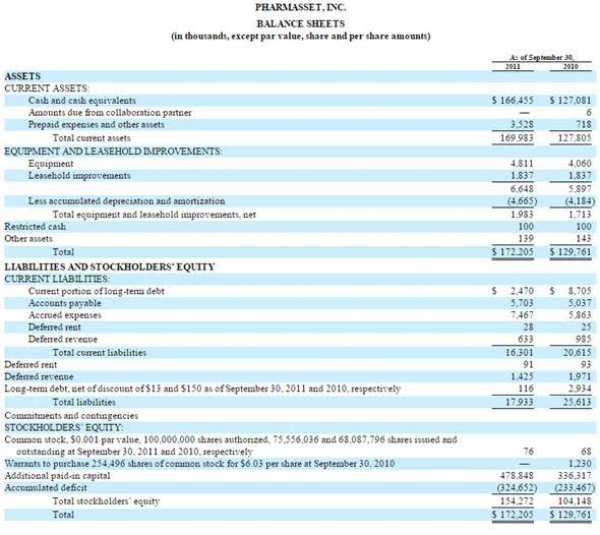

Now with Pharmasset we can look at the balance sheet immediately prior to Gilead's purchase. At the time the sunk capital cost (accumulated deficit) was $324 million. That's a lot of money, but nothing like the $7 billion valuation in the market (20x) or the sale price of $11 billion (33x).

That $324 million represents almost the ENTIRE development cost of this medication. There would have been another $50 million for the Phase 3 trials. Call it $400 million all in.

With some 613,000 people treated to date at around $50,000 per person the return is already north of $30 billion. That is 60 x the sunk cost in 3 years.

To treat the entire US population would be north of $200 billion. That is 500 x the sunk cost.

I believe Big Pharma takes big risks and has a right to big profits. The investors in Pharmasset got a 20 x + return and took almost all the risk. That does not seem entirely unfair. Gilead on the other hand took very little risk and is already sitting on 3 x at the price of 185,000,000 of our fellow citizens of the world being unable to access treatment and 500,000 a year perishing of a treatable disease.

If we are happy to live in a world where the cure for cancer is invented but only the super rich can afford it then that's fine.

If however we want to live in a world where patient lives balance patent rights we probably need to start thinking about how we provision decent, but not indecent profits and pricing practices.